Your dental insurance benefits are recalculated on an annual basis. The vast majority of people observe it on January 1st. But if your dental insurance is reset, it also means that the advantages from the previous year no longer apply. To put it another way, you have the option of carrying over an unused or expired insurance policy into the following year. After the expiration date, you will no longer have access to the insurance coverage, and you will only be able to take use of a limited amount of the coverage or benefits that are available to you between January 1 and December 31.

That means that once the page on the calendar is turned, any of your benefits that have been unused will be lost. Therefore, if you were unable to have that second (or first) checkup because of the pandemic in 2021, you will not be able to carry those missed appointments over into 2022.

It Is Important to Practice Preventive Dentistry

Regular visits to the dentist for cleanings and exams are the best way to maintain good dental hygiene. They also provide us with the opportunity to identify possible problems well in advance of those problems developing into major difficulties. The most exciting part? Your dental insurance most likely covers the cost of the best preventive dentistry services in full or very close to it.

When you go in for your checkup every six months, you will often receive preventive treatment. It is intended to improve the degree of dental health you currently possess and detect minor problems while they are still amenable to correction. The following are some examples of preventive services: dental cleanings; fluoride therapy; bite splints or mouth guards; oral cancer screenings; dental sealants for youngsters; periodontal evaluations; routine exams;

If you fall behind on your checkups, this could result in your out-of-date and expired insurance coverage being discarded. Throughout the course of the year, your regular premium payments have served as payment for those services. But you will lose them if you don't put them to use.

If you want to be sure that your dental insurance is "working" for you, the best thing you can do is to make sure that you schedule your checkups exactly on the dot every six months. Therefore, you will never fall behind on preventative care and will never have to worry about having to pay for treatment out of cash because your insurance coverage has run out.

Utilizing Your Restorative Benefits to Their Full Potential

When it comes to comprehending the extent of your dental insurance coverage, there are numerous treatment categories that fall under a variety of levels or tiers. As medical procedures grow increasingly difficult to carry out, they are promoted to more difficult levels of treatment. These several classifications of medical interventions are each covered at their own individual rates. Therefore, what might be covered at a rate of 75–80 percent if it's a basic filling could drop to 50 percent if it's a more extensive restorative surgery.

It is not possible to carry unused benefits over to the following year or to "stack" them with your new benefit allocation in order to pay for more extensive treatments. The coverage provided by the insurance policy that has since lapsed is no longer available. Because of this, it is highly recommended to make use of it while surgical treatments are still very minor and more reasonably priced. You are, in essence, putting your dental insurance to work for you, and as a consequence, you reduce the amount of money that you have to pay out of pocket for your dental care.

Not only are treatments administered sooner more affordable, but they are also less intrusive. Before problems such as decay or disease start to eat away at your smile, we are able to assist you in preserving a greater portion of the natural tooth structure that you have. If you put off getting treatment, eventually the tooth will get to the point where it can't be saved and it will fall out. At that point, it is typically necessary to eliminate it completely.

"I Am Unaware of the Benefits That My Insurance Provides"

Our dental professionals in Summerlin will do all in their power to explain the benefits and breakdowns of your insurance in a language that is simple and straightforward. You won't be taken aback by any unexpected costs if you do it this way. You will have access to all of the information that you require in order to actively participate in the planning of therapies. In addition, Dr. Cohan will make every effort to figure it out in such a way that each stage is finished before the end of the year, which is when the advantages of your dental insurance will be exhausted.

If you are unsure of the date of your most recent dental visit, please let us know, and we will check with your insurance provider to see what benefits are still available to you. In our medical practice, we are always happy to see new patients! When you phone to schedule your appointment, just make sure that you have your dental insurance card on hand before you do so. In this manner, we will be able to compile all of the necessary information prior to your arrival. In addition, we are able to inform you if the renewal of your insurance coverage occurs on a date other than January 1st.

COVID-19 resulted in a severe delay in dental care for an unprecedented number of individuals. To our good fortune, the majority of dental insurance coverage prioritize preventive dentistry as a primary benefit. You can reduce the overall cost of treatment in the future by taking advantage of the normal coverage and preventative services that your insurance plan provides.

But that's not the end of it. In the event that you do find yourself in need of treatment, it is imperative that you make use of the advantages that are contained in your plan before the 31st of December. Therefore, make sure that you schedule your appointment for preventative dentistry in plenty of time in advance so that you will have enough time to turn around and treat any problems that may have been going untreated up until this point.

Our dentist in Summerlin, Dr. Marianne Cohan, is a firm believer in providing care for dental health that is proactive, preventative, and less intrusive. Make sure to schedule your next visit as far in advance as you can so that we can assist you in maintaining good oral health (and dental care costs low.) Get in touch with Summerlin Dental Solutions right away.

CLICK HERE TO SCHEDULE YOUR APPOINTMENT!

GET TO KNOW YOUR BEST DENTIST IN SUMMERLIN

Dr. Marianne Cohan was voted The Best Dentist/ Dental Office and Best Cosmetic Dentist from The Las Vegas Review-Journal in 2020 and 2021. She received her Doctor of Dental Surgery (DDS) from the State University of New York at Buffalo in 1992.

With an emphasis on cosmetic dentistry, complete makeovers, and implant dentistry, Dr. Cohan is committed to continuing education and feels that we never stop learning. Dr. Cohan takes pride in using high-powered magnification to perform minimally invasive restorative dentistry. She uses all the latest technological advances including digital radiography, digital photography, computer simulations, and high-resolution pictures of your proposed treatment on 55-inch screens. She also utilizes CBCT (cone beam) and laser technology.

Dr. Cohan is always available to her patients and is available for any dental emergency.

HOW TO SIGN UP FOR A DENTAL INSURANCE PLAN AND FAQ’S

CLICK HERE for a list of insurances accepted at Summerlin Dental Solutions.

PEOPLE ASK:

How much is dental insurance?

Is dental insurance worth it?

How to get dental insurance ?

Does dental insurance cover implants ?

How much is a dental cleaning without insurance ?

How to get dental implants covered by insurance ?

does insurance cover dental implants ?

How much does dental insurance cost?

what insurance covers dental implants ?

how does dental insurance work ?

How much does a dental bridge cost without insurance?

CLICK HERE TO SCHEDULE YOUR APPOINTMENT !

The American Dental Association (ADA) reports that over half of all individuals acknowledge that they have not been to the dentist as frequently as they should have been.

Why?

Mainly due to the expense. It is a fact that dental operations such as root canals, cavity fillings, and even straightforward cleanings are quite pricey currently, with out-of-pocket prices frequently going into the hundreds of dollars. Dental insurance might be of assistance in situations like these.

This article explores the steps that need to be taken before deciding on a plan and provides information on how to obtain dental insurance. Still unsure? We have the answers to some of the most often asked questions, which can instill confidence in you so that you can purchase and make effective use of your insurance policy.

Things to consider when purchasing a dental insurance policy

The process of acquiring insurance now just takes a few minutes thanks to the user-friendliness of modern websites. Follow the steps below to ensure that the option you choose will be suitable for your needs before opting for the plan that appears to be the most convenient (and affordable) option.

CLICK HERE TO SCHEDULE YOUR APPOINTMENT !

First, we will determine who needs coverage.

Are you seeking for protection that just applies to you? Or,

do you have a partner or children for whom you will also require financial assistance to meet their dental costs?

If you fall into the second category, you have responsibilities for the people who depend on you. Determining just who needs dental coverage is step one. Are you happy to be an only child?

Proceed to the section on pre-existing conditions.

Did you know that dentists who work with children typically need to complete additional training in pediatric dentistry?

Because it requires a distinct set of expertise and training, this branch of dentistry is only included in some packages rather than others. If you believe that your children may require orthodontic treatment in the future at your Summerlin Dental office, full coverage plans are going to be your best option. When it comes to getting dental insurance for your children, you will need to have a general concept of what treatments are included in the plan as well as which pediatric dentists are part of your coverage networks.

SUMMERLIN DENTAL SOLUTIONS IS THE BEST COSMETIC DENTIST NEAR ME!

The second step is to gain an understanding of any pre-existing problems.

However, this only pertains to health insurance; it is still allowed for other types of insurance to exclude coverage for pre-existing diseases. The Affordable Care Act makes it unlawful for health insurers to reject coverage for pre-existing conditions. Regrettably, this measure does not explicitly mention dental insurance as a need for participation.

It's possible that your dental insurance claim might be rejected due to a pre-existing condition, which refers to an issue that you had with your teeth before you had dental coverage. Depending on the plan, a pre-existing ailment can include missing teeth or a previously confirmed case of gum disease. You will have an easier time finding insurance that covers you if you first determine whether you have a pre-existing condition.

CLICK HERE TO SCHEDULE YOUR APPOINTMENT !

The third step is to create a budget for personal expenditures.

It is not hard to prepare a budget for dental expenditures if you first go through the features of the insurance plans and then compare them.

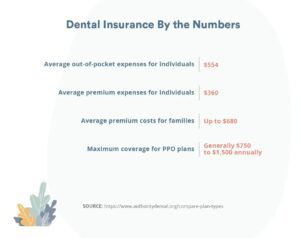

Find out how much your co-pay will be and how much of a deductible you will have to pay before your insurance begins to pay for anything. Because deductibles can reach upwards of $1,000, it is imperative that patients make every effort to save up the necessary funds before undergoing dental treatment. That wraps up the first section of your budget. A person's out-of-pocket costs for dental care are largely determined by the kind of dental insurance coverage that they have. The 100-80-50 guideline is frequently utilized in insurance plan design. Although there are few exceptions, the maximum amount that many plans are willing to pay out to applicants each year is often $1,500. Examine the many plan alternatives available to see which ones have out-of-pocket costs that are affordable given your financial constraints.

Step 4: Estimate the Length of the Waiting Periods

Anyone who is interested in acquiring dental insurance to have at your Summerlin Dental office can most likely start receiving cleanings or x-rays right now. However, you should be prepared to wait anywhere from six months to a year before receiving coverage for root canal therapy or treatment for gum disease.

Why?

At the end of the day, insurance companies are businesses. If these waiting periods did not exist, there would be nothing to prohibit individuals from enrolling in coverage for a period of one or two months just for the purpose of obtaining urgently required dental care, after which they would drop their coverage.

Waiting periods do not always indicate that more extensive dental work cannot be done immediately; nonetheless, individuals may be required to pay for the procedure out of their own money. Check once more your plan selections for any stipulations about waiting plans.

You have us fooled if you think that we are suggesting that you engage in a significant amount of reading. We are. But doing so will spare you a great deal of discomfort in the future.

Step 5: Determine if you want solo coverage or group coverage.

As of the end of 2016, the National Association of Dental Plans reported that around 250 million Americans have dental coverage.

These individuals were enrolled in one of two categories of plans:

What criteria do you use to make your decision? Individuals often get group plans through their workplaces or through organizations such as the AARP. Individual coverage is most likely what you'll go for if you're obtaining insurance on your own for the first time.

CLICK HERE TO SCHEDULE YOUR APPOINTMENT !

Tips for Selecting the Right Dental Insurance Policy

After completing the processes in the preceding section, it is now time to choose an insurance plan. Here are the steps you need to take right now to guarantee that you will have the necessary coverage.

Get a Good Understanding of Your Coverage.

Various kinds of dental care programs and policies

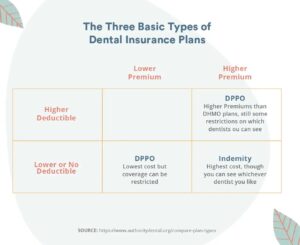

In most cases, there are three distinct categories for dental insurance policies to choose from. If you can determine which one is best for you, you can make the most of your money and ensure that you are not overpaying for the services you receive.

Regardless of the option you choose with, you will want to ensure that you have a clear understanding of exactly what the plan you chose covers and the percentage of covered costs that are reimbursed. You may often find further information on their website or in the literature that they provide you.

Indeed, you have it correct. Read on for more. Find a place to sit down where you won't be disturbed and start reading those insurance pamphlets.

Be aware of the dentists who participate in your insurance network.

If you do not get indemnity insurance, you will have limited options when it comes to choosing a dentist to treat you.

You are not prohibited from seeing dentists who are not part of your insurance network; nevertheless, doing so may result in additional costs for you. Consult the online network list of your prospective PPO or DHMO dental insurance plan if you are shopping for coverage. In most cases, dental practices will be aware of the insurance policies that they are able to take. Having said that, patients shouldn't let selecting a dentist who is part of their insurance network prohibit them from getting a second opinion.

CLICK HERE TO SCHEDULE YOUR APPOINTMENT !

Determine the extent of your coverage.

Right now, you need to give some serious thought to how much insurance coverage you require.

A reasonably priced plan that costs no more than a couple of hundred dollars per year and includes a couple of cleanings will pay for itself. Since cleanings aren't very pricey and can even be obtained for a reduced fee at dental schools, the decision to forego dental insurance totally may seem appealing; nonetheless, we do not advise taking this course of action. The price of $20 or $30 per month for dental insurance is well worth it when one considers the comparatively modest cost of the coverage and its availability in the event of an emergency. After that, you will need to choose whether a PPO, DHMO, or indemnity plan is best for you, as well as how much of a deductible you are willing to spend each month for your coverage.

Reduce the number of options you have.

When looking into acquiring dental insurance that you will really utilize at your Summerlin Dental office, you are currently in the research phase. Check out possible insurers' ratings and reviews on the internet to determine whether or not there is a strong probability that they will honor any claims. Check out the evaluations of the dentists who are part of their network as well. If upgrading your plan would result in greater coverage and access to a more reputable dentist, it may be worthwhile to pay a little extra for the plan.

dental insurance expenses

When you are ready to get dental insurance, the application procedure is rather simple and may often be completed in one of these three ways:

To reiterate, the labor done up until this point counts a great deal more than the real, straightforward business transaction itself.

Confused? Do you need further explanation on the advantages of having insurance? Here are some responses to some of the more often asked questions.

It's not quite that.

Finding the right dental insurance for you at your Summerlin Dental office requires taking into account a variety of aspects, such as the extent of your dental care requirements and your current financial standing.

It's possible that a high-deductible plan that covers routine checkups and cleanings, as well as urgent procedures like fillings and root canals, is the ideal dental insurance for younger individuals who have pretty healthy teeth. People who anticipate getting a significant amount of benefit from their dental insurance may, on the other hand, find that the same coverage makes their lives far more difficult financially.

Dental insurance may often be obtained through a number of distinct channels. After an initial waiting period at their employment, often lasting between 60 and 90 days, many individuals eventually become eligible for group dental insurance coverage. Others opt to get private dental insurance instead, either via the assistance of an insurance broker or by getting in touch with a dental insurance provider on their own. You may also acquire dental insurance by going online and purchasing it directly from the providers.

CLICK HERE TO SCHEDULE YOUR APPOINTMENT !

This is partially dependent on whether or not the individual intends to acquire dental insurance in addition to their Affordable Care Act plan. If this is the case, then the answer is yes; however, a person is not restricted to just getting dental insurance during open enrollment periods if they so want. There are times throughout the year when coverage can be purchased. They are also eligible to get dental insurance via the Affordable Care Act after experiencing a qualified life event such as the loss of their employment.

You may get information on open enrollment periods by visiting Healthcare.gov or the websites of state-based exchanges, like as Covered California's website.

It is not always easy to determine how much money you will actually spend on insurance. Although monthly premiums may be less than $20, that figure only accounts for a portion of the total cost.

Before beginning to pay for covered expenses, the deductible for many insurance policies must first be satisfied on an annual basis. Other plans provide for specific procedures, such root canals or treatments for gum disease, to be paid for partially (but considerably) out of pocket, and it is common for you to be responsible for covering at least fifty percent of the cost.

The cost of premiums can range from around $360 to up to $680 per year for people and families, respectively

Yes, but resist the urge to play one over on the other person. There is a good reason why the regulations governing insurance are straightforward and frequently lengthy.

As was mentioned previously, the majority of insurance policies impose waiting periods on certain treatments, including as root canals. These waiting periods are designed to deter patients from signing up for insurance shortly before getting extensive dental work done and then abruptly dropping their coverage

Dental coverage is not like a subscription to a video streaming service or a membership to a fitness center. Do not even bother doing it since there is a high probability that you will be unsuccessful.

GET TO KNOW YOUR BEST DENTIST IN SUMMERLIN

Dr. Marianne Cohan was voted The Best Dentist/ Dental Office and Best Cosmetic Dentist from The Las Vegas Review-Journal in 2020 and 2021. She received her Doctor of Dental Surgery (DDS) from the State University of New York at Buffalo in 1992.

With an emphasis on cosmetic dentistry, complete makeovers, and implant dentistry, Dr. Cohan is committed to continuing education and feels that we never stop learning. Dr. Cohan takes pride in using high-powered magnification to perform minimally invasive restorative dentistry. She uses all the latest technological advances including digital radiography, digital photography, computer simulations, and high-resolution pictures of your proposed treatment on 55-inch screens. She also utilizes CBCT (cone beam) and laser technology.

Dr. Cohan is always available to her patients and is available for any dental emergency.